UK Recruiting Trends

The world of work rebounds

2021 started off with hope and optimism in the air. A Brexit deal was done, and new vaccines brought with them the hope that we could soon get back to some kind of normality and start our journey on the road towards economic recovery. However, even the most optimistic analysts did not predict quite how the labour market would swing from the first to the second quarter of this year.

The news of a third national lockdown, which began on the 4th of January, quickly sapped away positivity as we once again saw Covid-19 infection rates soar. Businesses started to feel the immediate impacts of Brexit and had to wrestle with new red tape, including costly checks and custom controls, which subsequently disrupted supply chains across the country.

But by Q2 market conditions really began to change. The easing of lockdown measures and the reopening of pubs, shops and restaurants along with the rapid progress of rolling out the Covid-19 vaccine, fuelled consumer spending. In fact, retail sales rebounded in March, well before the official re-opening, as consumers began to spend accumulated savings and manufacturer confidence returned to levels not seen since 1973. As a result, the demand for labour crept back to pre-pandemic levels, companies started to hire again, and the unemployment rate fell.

Our own registered vacancy numbers reflected wider market conditions at this time. In May 2021, Stanton House registered the most vacancies since May 2019.

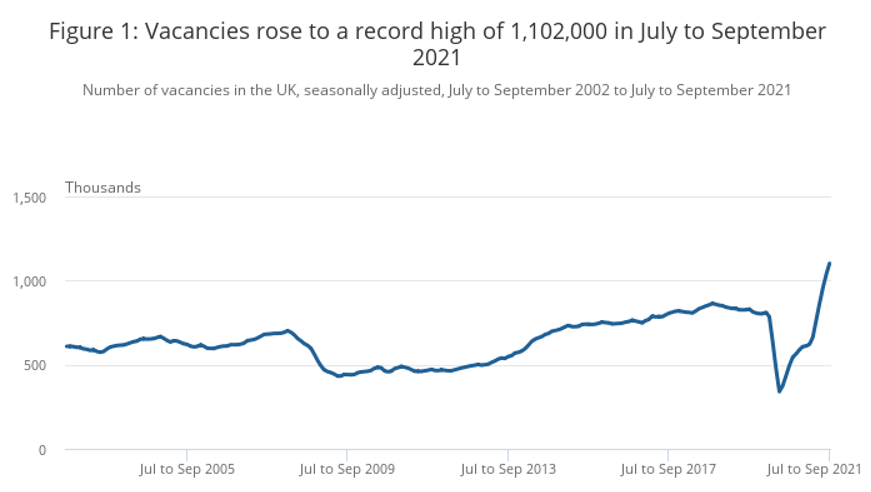

Job vacancies reach record highs

The good news is that this momentum shows no signs of slowing down and the demand for skilled professionals will no doubt continue unabated throughout the last quarter of this year. Organisations, across most industries, continue to aggressively hire to meet customer demand and to deliver key projects that will enable transformation and growth.

Yael Selfin, Chief Economist at KPMG UK, recently said: "The labour market has outperformed expectations as the economy accelerated with the relaxation of Covid-related restrictions.”

The quickening of our economic recovery has fuelled the demand for labour. According to the Office of National Statistics (ONS), the number of job vacancies from July to September 2021 was a record high of 1,102,000, an increase of 318,000 from its pre-pandemic (January to March 2020) level; this is the second consecutive month that the three-month average has risen over one million.

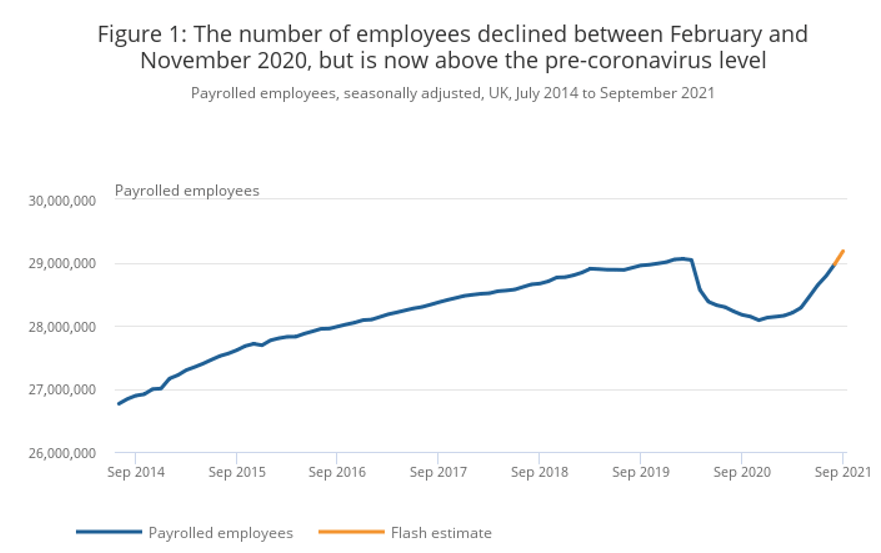

Unemployment rate continues to fall.

The number of payrolled employees showed another monthly increase, up 207,000 to a record 29.2 million in September 2021, returning to pre-coronavirus (COVID-19) pandemic (February 2020) levels.

As the number of payrolled employees has continued to rise, the unemployment rate has continued to fall and is currently under 5%.

ONS latest Labour Force estimates for June to August 2021 show the employment rate increased by 0.5 percentage points on the quarter, to 75.3%. and the unemployment rate decreased by 0.4 percentage points, to 4.5%.

The cost of employing payrolled individuals rises

Employers and workers across the UK are braced to pay out more in National Insurance. Boris Johnson recently announced a 1.25% rise in National Insurance for employees and employers which will kick in from April 2022. It will then become a separate tax on earned income from 2023 - appearing on an employee's pay slip as a "Health & Social Care levy".

Upturn in demand for flexible resource set to continue

The latest Report on Jobs survey by KPMG and the Recruitment and Employment Confederation (REC) backs the ONS jobs data. According to the report, recruitment activity continued to rise rapidly across the UK at the end of the third quarter, fuelled by robust demand for staff and rising economic activity.

The report indicated a further increase in overall vacancies during September which continued to climb at a record pace. It showed steep increases in demand for both permanent and temporary staff.

For most businesses, the workload of their staff has increased and access to flexible resource has allowed them to bolster their teams to get them through difficult periods. Interims and contractors provide a short-to-medium-term solution for most organisations, whilst typically not impacting Full-Time Equivalent (FTE) budgets. As such, we expect the high demand for flexible resource to continue with the current trend of renewing and offering longer-term contract extensions.

Managed Solutions rise from IR35 fallout

2020 saw Chief Secretary to the Treasury Steve Barclay announce that IR35 tax reforms to the private sector would be deferred to 6th April 2021. While this gave private sector businesses crucial extra time to review and refine their interim hiring strategies, we initially observed a dramatic reduction in the recruitment of interim / contractor resources and many organisations were hiring flexible labour on an inside IR35 basis only.

Indeed, many businesses decided to instigate a blanket ban of personal service companies (PSCs) rather than contend with the perceived risk of potential financial liability for tax, should contractors later be deemed in scope of IR35. We started to see that these risk-averse reactions to IR35 were depriving some companies of their competitive edge and ultimately, their ability to attract the best interim talent.

As Covid-19 continued to put pressure on the cost-base for many businesses into 2021, we saw companies swing from the use of LTD contractors to umbrella companies and fixed-term contracts - both options usually meant a significant financial hit on the interims take-home pay. Arguably, some businesses adopted this approach to cost-cut quickly, at a time when costs were being scrutinized more than ever.

With April 6th now behind us, we have seen a revival of day-rate contract roles as businesses continue to review and amend their processes to ensure key teams and business-critical projects stay adequately resourced. The volume of our registered permanent opportunities exceeded interim roles by 4:1 prior to the 6th of April, however, this has since started to swing back a little.

As organisations start to build (and in some cases re-build) their teams to respond to challenges such as margin pressures; slowing growth; poor data and insight; stubborn cost bases and legacy IT infrastructure, they appear to be finding a balance between permanent, fixed-term contract and both inside and outside IR35 contract roles.

The pandemic has made it abundantly clear how dependent organisations are on technology for business continuity, enabling organisations to rapidly adapt and respond to customer needs throughout times of change. As such, companies are continuing to invest in business, finance and technology-led transformation programmes and projects.

So, as an increasing number of industry sectors require interim expertise to lead their teams and projects, more and more commercial organisations are shifting from the traditional use of contractors, each one sourced separately, to using Managed Solution providers who deliver Statements of Work (SoW) to accelerate project delivery and growth.

At Stanton House we have seen exponential growth of our Managed Solution offering (SHMS), providing embedded flexible teams which enable clients to scale and adapt as priorities change.

Contact us to learn how our solutions for individual IR35 determinations and Managed Solutions can help deliver a compliant and cost-effective answer to flexible labour demands.

The talent gap widens & skills shortages blamed on Brexit

Demand for labour may have hit record highs but skills shortages threaten to stall our economic recovery. There’s a clear and deepening mismatch between the skills of people on the unemployment register and the skills needed for the rising number of permanent and contract vacancies.

Couple this with the fact that candidates are still risk-averse when it comes to changing jobs in the current climate, and it isn’t surprising that we have a war for talent going on.

Yael Selfin, Chief Economist at KPMG UK, recently said: "Changes to the business environment, such as the fall in business travel and the rise in online commerce, increased the need for skills, from IT specialists to hauliers, while at the same time caused an unusually high level of mismatch in the UK's labour market."

While companies want to invest in their business, now that restrictions have lifted, demand for new staff still outstrips supply due to low candidate availability. According to the REC, candidate availability fell in July at the second-fastest rate seen in the survey’s history.

Employers are now having to re-think their hiring strategies, make quicker decisions and evolve their Employer Value Proposition (EVP) so they can attract the best talent in a highly competitive environment.

Brexit has been cited many times as a key factor reducing the supply of flexible labour and contributing to the fact that our economy just isn’t bouncing back like others around the world. The latest OECD outlook shows the US has already reached pre-crisis levels of GDP per capita, yet the UK is not expected to catch up until July next year.

The increased level of bureaucracy and compliance implications for UK employers, imposed by the new immigration system, is slowing access to the flexible labour market across Europe. Sectors that typically employ foreign, young and/or seasonal workers are suffering the most. Covid-19 has seen hundreds of thousands of employees lose or leave their jobs, and in many cases leave the UK altogether. Brexit means that the right for EU workers to just turn up has gone – so it is now much harder for EU workers to return to the UK.

What’s more, record numbers of young people are choosing to stay in education and are not looking for work. From retail, entertainment and hospitality to factories, farms and logistics, many industries are warning they won’t be able to bounce back due to skills shortages - unless post-Brexit rules on immigration are relaxed.

Starting salaries & contract rates inflate

The mismatch in labour supply and demand can only lead to one thing. Salary inflation.

Employers are desperate to find good candidates, for the many jobs on offer, and this is reflected in the fact that starting permanent salaries and contract rates have been rising - fast. The ONS reported that wage inflation soared by 7.4% between April and June 2021 and for the three months June to August 2021, data showed growth in average pay of 7.2%.

According to the REC’s latest Report on Jobs, the rising demand for staff and a near-record fall in candidate availability drove substantial increases in starting pay. Notably, permanent starters’ salaries and temp wages both rose at the sharpest rates in 24 years of data collection.

All that said, the ONS has urged caution in reading too much into the recent rises in average pay. Although wage inflation hasn’t been this high for a long time, it also compares to last year when millions of people were on furlough and were not being paid their full wage.

Increased M&A activity leads to more opportunity

The UK came into 2020 on the back of a decade-long bull run in Private equity deal activity, setting new peaks for annual deal value, despite the uncertainty of Brexit. The pandemic, however, put the brakes on high volume deals for the majority of 2020.

This year paints a different picture. Overall IPO volumes are on the rise and the M&A world seems to have kicked into gear which is creating more opportunity across our PE client base.

PE investors are now focusing on these new opportunities and the forecast for the industry is overwhelmingly positive. We are seeing this translate to increased demand for senior professionals - from PE backed technology businesses in particular.

What should employers be doing right now?

The Bank of England has always suggested that employment would get back to normal by the end of this financial year. But it looks like we are going to get there a lot quicker.

For employers, this means that there are just fewer people to choose from at the moment and what’s more, candidates have a lot more choice given the record number of vacancies.

Furthermore, The Bank of England predicts that unemployment is likely to keep decreasing until 2024, so talent pools will only continue to shrink.

So, what should employers consider doing in such a competitive market? Here are six things you can do right now:

1. Don’t wait. Hire the talent you need now. Wage inflation is likely to remain at high levels. It is currently at 7.2% (June to August 2021) and to put that into context, pre-covid it was at 2.2%. If you need someone, hire them now – talent pools are decreasing so it is only going to get more expensive to recruit. The quicker you can move, the higher chance you have of landing a candidate interviewing with you. If your recruiting process moves slowly, you will have other companies’ job offers undercutting yours. A candidate may rank your opportunity the highest, but between a 50% chance of landing yours and a 100% of landing another good option, most will go for the safe bet.

2. Keep up with salary inflation. Are you offering the right level of pay to existing staff? Is it enough to retain the key skills you need? Are you offering the right level of pay for your new roles? Reach out to your Stanton House contact for help with your salary benchmarking.

3. Stay organised. Try and make the candidate journey as slick as possible. A disorganised process will make you look like a disorganised company. Missed scheduling emails, incorrect Zoom links, slow feedback – any one of these can sink all the work you put into interviewing so far.

4. Assess the skills and competencies you require. Be more flexible on what you consider to be the essential versus desirable skills and competencies for each role. Can you reshape a role / broaden responsibilities to make it more attractive to a wider pool of talent? Reach out to your Stanton House contact so we can get ahead of the curve and start building the talent pools your team needs to grow.

5. Evolve, articulate and promote your Employer Value Proposition (EVP). What is it about you that is different? What makes you stand out as an employer of choice? Why should people want to come and work for you? Are you a diverse and inclusive employer? Are you committed to flexible working, and how do you prioritise the mental wellbeing of your employees?

6. Offer remote & flexible working. You will struggle to hire candidates if you require them to be in the office all of the time. Flexible and remote/hybrid working is taken as a given these days!

How can we help?

If you’re looking to hire a permanent or contract professional or need support with a specific project, we can help find the expertise you need - even in the face of prevailing skills shortages.

Equally, if you’re looking to take the next step in your career, or you are ready for your next assignment, please get in touch.

You can find our advertised opportunities and further insights on our blog page.